Our mission is to create extraordinary value with integrity to mutually benefit others.

Our history

Formerly known as International Mercantile Corporation (Intermerc Corporation, or the Company). Intermerc began as a Delaware corporation in January of 1989 and was in continuous operation for more than 25 years. Early co-founders included Dan Carney (founder of Pizza Hut), Frank W. Barton (founder of Rent-A-Center) and David F. Hoff (President/CEO).

From the beginning Intermerc Corporation was almost exclusively focused on the banking sector. While the Company expanded its reach to involve more Fortune 500 companies later, it has always maintained its close ties to Financial Institutions. The majority of all Intermerc’s bank related activities have involved Top 100 USA Bank Holding Companies and their affiliates. However, Intermerc also tracks and maintains market intelligence on all bank holding companies with $1 BIllion or more in assets.

Our why

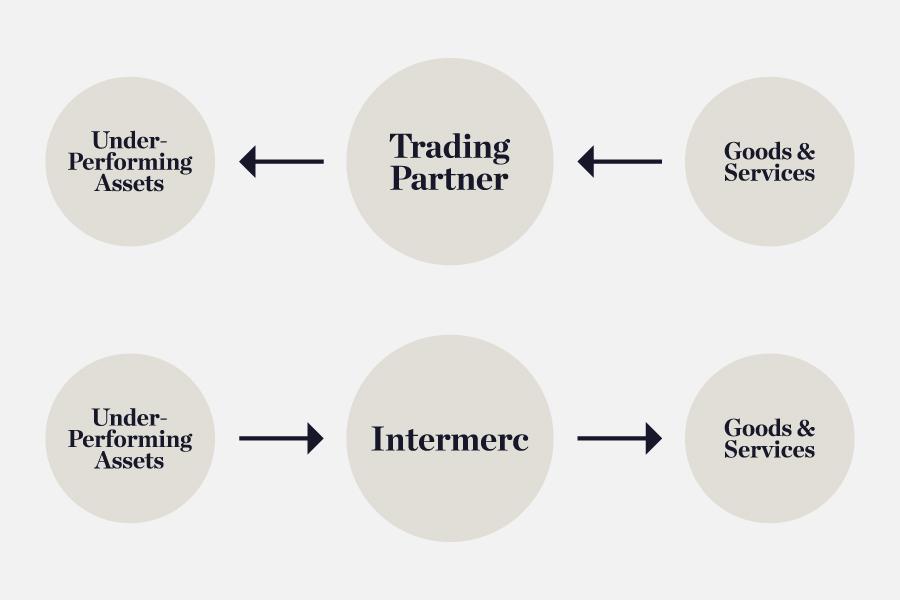

Intermerc’s unique differentiator in the market has always been its proprietary asset exchange framework that, enables selling entities to realize significantly higher yield than any other form of divesture. After socializing this unconventional transaction framework, the Company successfully closed a large number of deals with some of the biggest banks and corporations in America.

Pioneer of the Intermerc Corporation David F. Hoff later deactivated the trading business to focus on his health, family, and to manage and sell the CRE assets previously acquired. Mr. Hoff was unable to successfully recover from subsequent health events or return from his sabbatical to resume the trading business.

Our future

Today the legacy, history and knowledge of David F. Hoff and Intermerc Corporation continue to provide extraordinary value under a new flag, International Mercantile Americas, LLC (Intermerc) managed in succession by Kevin B. Hoff.

Intermerc is a diversified trading company which is currently taking positions in various under-performing assets (NPA’s) held by Major Financial Institutions, as well as Global 1000 and select Privately Held Companies. Areas of interest include Real Estate (OREO), End of Life IT Equipment, Secured and Unsecured Commercial Loans, Charge-Offs and Inventories of Consumer & Commercial Goods of all types.

We do what we do best to make life better.